Variable Annuity Pension Plan (VAPP): Predictable Employer Costs & Lifetime Participant Income

A Variable Annuity Pension Plan (VAPP) can provide predictable employer costs & lifetime participant income. A VAPP can also eliminate interest rate risk.

Nov 30, 2015

What is a VAPP?

What is a VAPP?

A Variable Annuity Pension Plan is a defined benefit (DB) pension plan that provides a lifetime income to participants, may increase payments to offset inflation, and provides contribution and balance sheet stability to plan sponsors. Regardless of asset performance or interest rate fluctuations, a VAPP will remain well funded.

How does a VAPP work for participants?

A VAPP sets a conservative investment return rate (the “hurdle rate”) and the participants shoulder the investment risk. Retirement benefits paid to participants are adjusted up or down by the difference in the actual rate of return and the hurdle rate. But, unlike a defined contribution plan, participants will not outlive their retirement income, and they’ll reap the rewards of investment gains.

How does a VAPP work for plan sponsors?

Because a VAPP adjusts the retirement benefits based on actual rates of return, the expectation for future benefit adjustments is used to value liabilities. The effect is that changes in the assumed interest rates do not change the liabilities of a VAPP. A change in the assumed interest rates implies a change in the expected future benefit payments. As a result, the liabilities can be valued at the hurdle rate for all purposes, eliminating interest rate risk for the plan. Because the investment risk and reward is borne by the participants, the plan sponsor is isolated from investment risk.

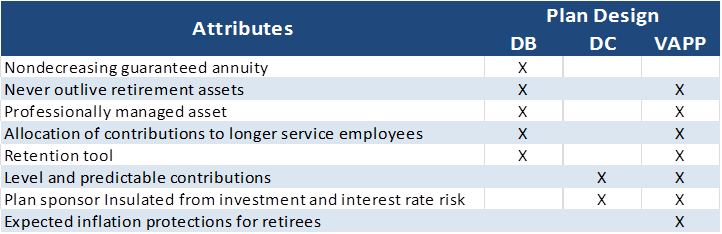

Comparisons of DB, DC and VAPP plan designs

If you would like to find out more about this type of defined benefit plan design, please contact your BPAS Actuarial and Pension Services Consultant. We can help you explore different options.