Studies show that participants are unprepared for retirement. How do we help them? It’s tough because there are so many variables to saving for retirement so there is no magic dollar amount that works as a target for everyone. As a result, business owners are looking for ways to ways to maximize contributions and tax deductions outside of traditional 401(k) profit sharing plans.

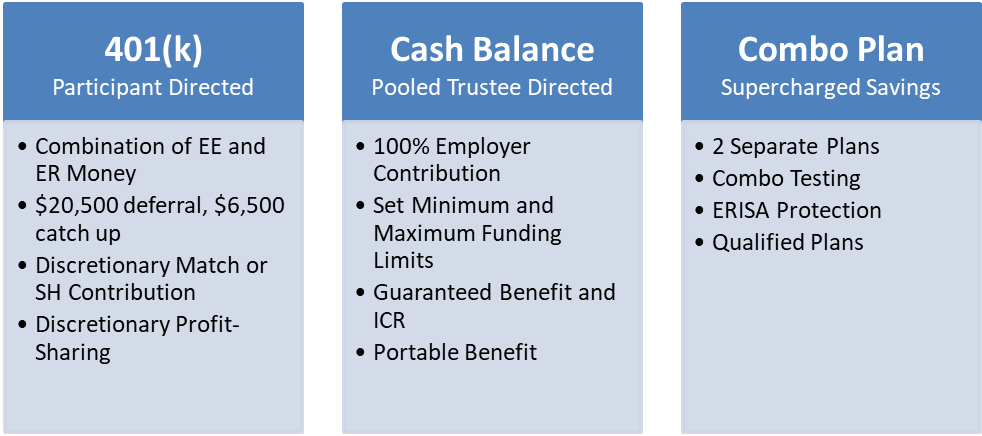

It’s the perfect time to look at Cash Balance Plans (CBP). Implementing a CBP in addition to a 401(k) profit sharing plan gives business owners the opportunity to save significantly more on a pre-tax basis and have much larger account balances at retirement than with a 401(k) alone. Here’s how.

While most business owners participate in a 401(k) plan with a profit-sharing feature, there are limits on how much they’re allowed to save for retirement. For 2022, the maximum amount a participant is allowed to save in a 401K plan is $61,000. Many successful business owners want to put more toward retirement on a pre-tax basis. As an example, if a business owner is age 50 or older, he/she may contribute the maximum $61,000 to the 401(K) and an additional $6,500 as a salary deferral with the CBP, making a total contribution of $67,500.

As the chart below indicates, the amount of contributions allowable to a CBP is considerably higher than a 401(k) profit-sharing plan. Plus, it grows, as the owner gets older.

Sample Maximum Service Credits

| Age | Maximum Credit* | Tax Savings at 45%* |

|---|---|---|

| 30 | $64,000 | $28,800 |

| 35 | $82,000 | $36,900 |

| 40 | $105,000 | $47,250 |

| 45 | $135,000 | $60,750 |

| 50 | $173,000 | $77,850 |

| 55 | $222,000 | $99,900 |

| 60 | $285,000 | $128,250 |

| 62 | $315,000 | $141,750 |

| 65 | $296,000 | $133,200 |

*These amounts are based on limits in 2022 under Internal Revenue Code Section 415 and the potential tax savings are illustrated at 45% estimating the cumulative taxes of federal, state, and Medicare payroll taxes.

An important note is that a CBP is a separate plan with contributions that are in addition to the 401(k) profit sharing plan. Based on the above chart, a 62-year-old could contribute up to $315,000 to a CBP in addition to the 401(k) profit sharing plan contribution.

Components of Combo CB Plans

The main concern about a Defined Benefit (DB) plan for plan sponsors is the commitment to employees. A CBP fixes it because a participant’s account is the cumulative value of service credits (e.g., 2.5% of pay) and interest credits (e.g., 4% of the prior year’s account balance). To participants, a CBP looks the profit-sharing plan. Yet, the interest credits are defined in the plan and guaranteed by the sponsor so it’s actually a qualified DB plan.

Because interest credits are guaranteed, sponsors usually define them based on a conservative index (like the yield on five- or ten-year Treasury notes), and invest plan assets conservatively. Under a CBP, the employee commitment is the service credits (which are covered by plan contributions) and interest credits (which are intended to be covered by investment returns). So, it’s very different from a traditional DB plan that provides a guaranteed level of income to employees upon retirement.

A CBP allows employees to convert their account balance into an actuarially equivalent life annuity upon retirement. However, the experience with new cash balance plans is that participants usually take their benefit in the form of a lump sum.

Here’s a common plan design to maximize contributions for business owners: Employees receive combined contributions to the CBP and profit-sharing plan equal to 7.5-10% of compensation.

Since many owners sponsor profit-sharing plans with contributions greater than 7.5% to employees annually, they can implement a CBP with no incremental contributions on behalf of employees.

One final point: a CBP is a qualified pension plan. Under IRS rules, it’s meant to be “permanent.” Permanency is satisfied if a plan is in existence for at least five years, so implementing a CBP should be done with this time requirement in mind.

The financial markets of 2022 have significantly reduced the value of almost everyone’s retirement accounts and resulted in many business owners reassessing when they will be able to retire. Implementing a CBP gives business owners the opportunity to save much more than what’s available in a profit-sharing plan alone and ultimately allow them to retire earlier.

To learn more about CBPs, contact Jason Disco at BPAS Actuarial & Pension Services or mail [email protected].