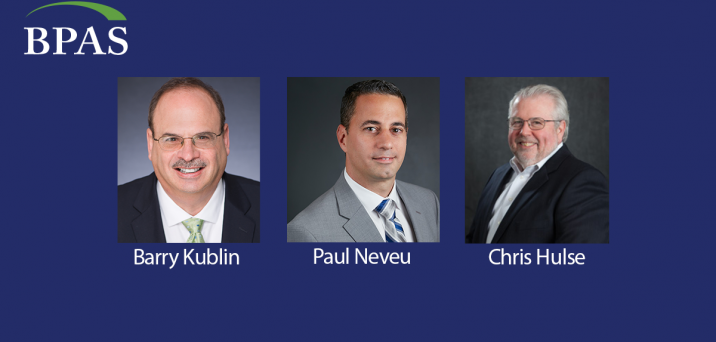

BPAS Announces Retirement of CEO Barry Kublin

Barry Kublin will retire as CEO effective December 31, 2020. He will remain with BPAS in Board of Director and advisory capacities. Paul Neveu will succeed as CEO of BPAS and Chris Hulse will succeed as CEO of NRS/BPAS trust services.

Dec 02, 2020

Utica, NY (December 2, 2020). BPAS, a national provider of retirement plans, benefit plans, fund administration and collective investment trusts, announced today that Barry Kublin will retire from his position as CEO effective December 31, 2020. He will remain with the company in Board of Director, strategic consulting, and industry advisory capacities. Paul Neveu will succeed Kublin as CEO of BPAS and Chris Hulse will succeed Kublin as CEO of NRS/BPAS trust services.

“It was a great run of 36 years,” said Mark Tryniski, CEO at Community Bank System, Inc. (CBSI), the BPAS parent company. “Barry is a rare individual who is adept at both strategy and execution. He is entrepreneurial and operational, and a serial opportunist — which is how he was able to grow a business from scratch to more than $100 million in annual revenues. We’ll continue to benefit from his vision, expertise, and industry relationships in his new capacity.”

Kublin joined Community Bank in 1985 as VP of Human Resources, where he conceived and launched its initial employee benefits business. Kublin then led the acquisition of BPAS in 1996, which at that time had fewer than 10 employees and $1 million of revenue. Under Kublin’s leadership, BPAS today has more than 365 employees, $100 billion in trust assets, $1.3 trillion in fund administration, and serves more than 450,000 participants.

“I have thoroughly enjoyed my time with BPAS,” Kublin remarked. “Entrepreneurship and leadership are about challenging the status quo and overcoming resistance from its guardians. I have been very fortunate to work with colleagues who welcome change, and look forward to continuing to support the company as a resident in the Caribbean.”

In becoming CEO of BPAS, Paul Neveu will expand his current responsibility over BPAS Plan Administration and Recordkeeping to include BPAS Actuarial & Pension Services, the business operations of Fiduciary Services and BPAS Trust Company of Puerto Rico, Marketing Communications, Accounting, and certain other key areas. Neveu joined BPAS in 2005 after nine years with Federated Investors and several years with Coopers & Lybrand (now PWC) in Boston. Neveu became President of BPAS Plan Administration & Recordkeeping Services in 2015, working under Kublin. He is a graduate of the University of New Hampshire with a dual degree in Business Administration and Music Performance.

“Barry is truly a legend in the industry — a friend and mentor who has shaped me over the years,” said Neveu. “As we move into the future, we recognize the foundational principles that Barry instilled into our culture. They will always be part of the BPAS story. During the transition, we will maintain our focus on continued stable growth and new technology to bring solutions that create efficiencies across our retirement and employee benefit businesses. Our technology focus includes the recent rollout of the BPAS University mobile app; new functionality in our web portals; more financial wellness options for participants; and exciting new developments in our VEBA HRA, actuarial, and IRA businesses. We will always be looking to deliver value for plan sponsors, partners, and participants. It’ll be a fun and exciting time, with an amazing team of professionals leading various business lines within BPAS.”

“Paul has been instrumental in driving the growth and success of the BPAS Defined Contribution business over the years,” said Tryniski. “I am excited about the energy and passion Paul will bring to this new role. We will continue to grow BPAS under his leadership through new and existing client channels, technology, and expanded products and services.”

Chris Hulse, who is CEO of Northeast Retirement Services (NRS) and its subsidiary Global Trust Company (GTC), will assume the additional responsibilities for Hand Benefits & Trust, including its collective investment fund and common fund business, and the trust activities of BPAS Trust Company of Puerto Rico. Chris is responsible for the strategic direction of the firm’s trust business, including daily client servicing and operations. Prior to assuming the CEO position, he was the NRS/GTC Chief Operating Officer for the past 15 years.

“NRS has grown dramatically under Chris’ leadership,” added Tryniski. “He’ll be working closely with Stephen and David Hand as we continue to grow our collective trust business. We look forward to the ongoing contributions of Chris and Paul in their new leadership roles, and recognize Barry for his 36 years of invaluable service in building the BPAS organization.”

About BPAS

BPAS is a national provider of retirement plans, benefit plans, fund administration, and collective investment trusts. We support 3,800 retirement plans, $100 billion in trust assets, $1.3 trillion in fund administration, and more than 450,000 participants. With our breadth of services, depth of creative talent, and financial resources, we are well-positioned to help our clients solve all their benefit plan challenges without the need to engage multiple providers. One company. One call.

BPAS services: Plan Administration & Recordkeeping, Actuarial & Pension, Collective Investment Trusts, Fund Administration, Custody, Transfer Agency, 3(16)/3(38), Healthcare Consulting, IRA, HSA, VEBA/HRA, FSA.

BPAS specialty practices: Auto Enrollment Plans, Multiple Employer Trusts/Plans, Plans with Employer Securities, Puerto Rico Section 1081 Plans, VEBA/HRA Plans, Cash Balance Plans, Collective Investment Trusts, and Fund Administration.

BPAS subsidiaries: BPAS Trust Company of Puerto Rico, Global Trust Company, Hand Benefits & Trust, and NRS Trust Product Administration.

As a solutions-oriented national practice, we are committed to “Solving Tomorrow’s Benefit Challenges Today.”