American Rescue Plan Act of 2021 Funding Relief for Single-Employer Pension Plans

The American Rescue Plan Act (ARPA 2021) signed into law by the President provides funding relief for single-employer pension plans.

Mar 15, 2021

Recently, we released a newsletter providing details on potential funding relief for single-employer defined benefit pension plans. That newsletter detailed some of the potential changes to the minimum funding rules that may be on the horizon. On Thursday, the President signed a modified version of the bill into law. Below is a summary of some of the pertinent changes.

Summary of Current Regulations

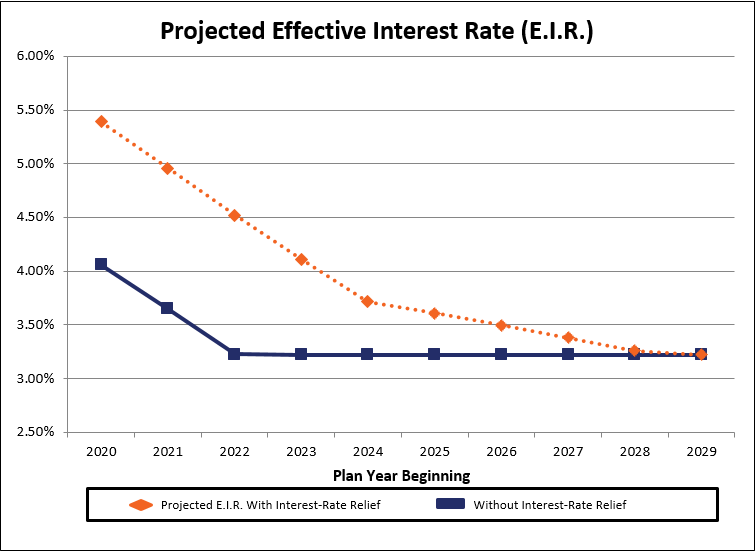

Under prior regulations, the interest rate relief provided under the Bipartisan Budget Act of 2015 was scheduled to begin phasing out in 2021. In particular, the 10% corridor around the 25-year average of rates that has been in effect for several years, was set to expand to a 15% corridor in 2021 with further expansion in 2022 – 2024 at an additional 5% per year until reaching 30%. The graphical representation below shows the changes in interest rates that were expected to occur over the next several years as the corridor expanded, assuming rates remained at or near current levels.

American Rescue Plan Act (ARPA 2021) – Changes

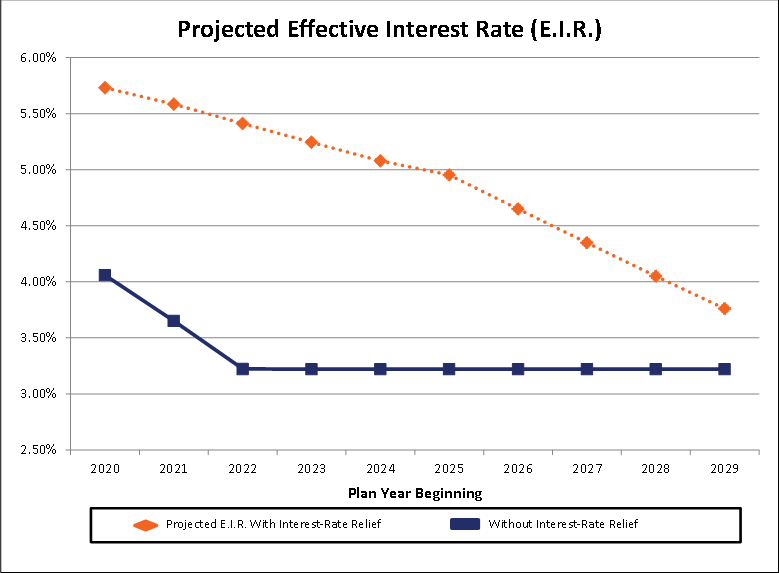

The ARPA 2021 legislation provides for several changes related to the interest rates used for minimum funding purposes. First, ARPA 2021 includes an interest-rate floor of 5% on the 25-year average of rates. This provision alone means that a Plan’s effective interest rate will not fall below 3.50%. In addition to the interest-rate floor, the legislation provides for a revised corridor schedule. It will reduce the corridor to 5% with the ability to adopt it retroactive to 2020. This 5% corridor would remain in effect until the plan year beginning in 2025 and then increase by 5% per year until fully phased in at a 30% corridor for the plan year beginning in 2030. The following is a representation of the expected effects on our sample plan.

As you can see, the interest rate relief will have a profound effect on the rates used to determine minimum funding requirements. Because the mandated interest rates affect minimum required contributions and benefit restrictions under IRC 436, implementation of the new rates will move plan funded percentages higher. The new law allows plan sponsors some flexibility regarding the timing of adoption for plan years beginning prior to January 1, 2022. It also allows the expanded interest rate relief to be adopted for either minimum funding purposes, benefit restriction purposes, or both depending on each sponsors particular circumstances.

The legislation also increases the time period over which any funding shortfalls may be paid. It expands the time period from 7 years under current law to 15 years. The combination of higher minimum funding interest rates and a longer amortization period over which to spread any underfunding comes as welcome relief to cash-strapped sponsors of single-employer defined benefit pension plans. In addition, the change in amortization periods is allowed, retroactively, to plan years beginning in 2019 for those plan sponsors who wish to elect it.

Have questions? Contact your BPAS representative for more information.