For the Youngest of the Baby Boomers, Some Words of Encouragement

The first of the Boomers are now retired or semi-retired and we’re now looking at the 60’s and 70’s in our rear view mirrors.

Sep 16, 2014

This post originally appeared on the Nottingham Advisors blog. Nottingham Advisors is a subsidiary of Community Bank System, BPAS’ parent organization. The author, Kathy Strohmeyer, has 41 years of industry experience.

Okay, I admit it. I’m a Baby Boomer. The first of the Boomers are now retired or semi-retired and we’re now looking at the 60’s and 70’s in our rear view mirrors (A.K.A. the coolest decades e-v-e-r!). Younger people can get away with the longer hair, dressing different, etc., but wearing madras and teasing hair is a thing of the past. What works now for Jimmy Buffett doesn’t necessarily work for you (although ‘Cheeseburger in Paradise’ will forever work).

Okay, I admit it. I’m a Baby Boomer. The first of the Boomers are now retired or semi-retired and we’re now looking at the 60’s and 70’s in our rear view mirrors (A.K.A. the coolest decades e-v-e-r!). Younger people can get away with the longer hair, dressing different, etc., but wearing madras and teasing hair is a thing of the past. What works now for Jimmy Buffett doesn’t necessarily work for you (although ‘Cheeseburger in Paradise’ will forever work).

The youngest of the boomers are now around 50 years old. At this age, you may feel you’ll never retire because you still have the energy and the drive to work so saving is taking a back seat to other things. Trust me, in time you will feel differently. Freedom to do what you want when you want is a beautiful thing. I know from experience. Chances are you will regret not thinking about saving when you find out you’ll have to work until you’re 80.

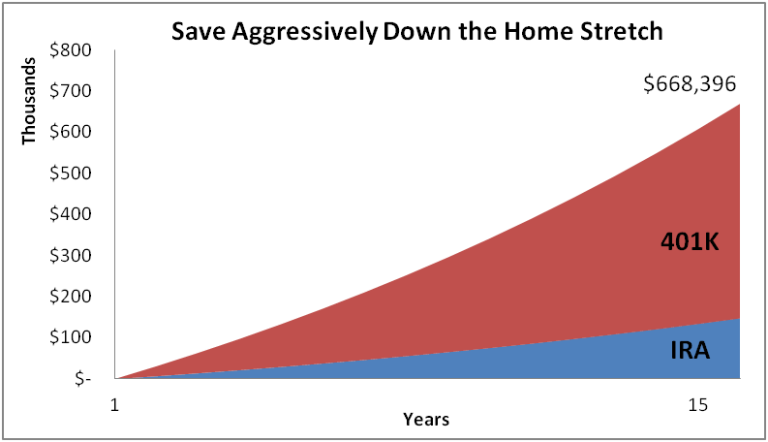

Fortunately, around 50, you can really ramp up your saving during the home stretch to retirement. By this time, it’s possible the kids are out of college and on their own and the house is paid off, along with most other debt. What’s more, you are now in your peak earning years. You can picture that summer beach house, so file your regrets away and let’s look to the future! Assuming you’ve been contributing to your IRA (traditional or Roth) and your 401K for some years, now is the time to amp it up even further. A general rule of thumb is to retire with savings roughly 20x your annual salary. It may sound over-the-top but with so many variables in retirement – better safe than sorry.

Let’s consider an example with the (almost always) hypothetical Smith family. Jim Smith and Mary Smith have paid off their house. Their only son, Herbie, has graduated college and is now out on his own starting his young career as a dentist. With a large portion of their fixed costs eliminated, the Smiths strive to fully fund an IRA and put the maximum in a 401K.

Suppose the Smiths max out on annual contributions for the next 15 years ($6,500 for an IRA and $23,000 for a 401K in 2014 for those over 50). Assuming a conservative 5% annual return, they would have $147,274 in their IRA ($6,500 X 15 years) and $521,122 in their 401K ($23,000 X 15 years). Their savings would soar to $668,396! Not included in any of this is the employer match or any other savings they made prior to this. Along with Social Security and possible pensions, their retirement is looking nicer and nicer.

Now, expecting everyone to make the maximum contribution is not realistic. Not everyone has the luxury to do that, but my main point is that the time to start saving is now. You can enjoy life to the fullest and still be diligent in saving for your future. Everyone is different, but get as aggressive as your situation permits. The IRS has some different rules surrounding maximum contributions for those under 50 or those above certain income thresholds, so consult your accountant and get moving. It is never too late. Retirement is filled with great richness and emotional clarity, but try not to rush it either.

A wise man once wrote, “Grow old with me, the best is yet to be.” I think he may be right.

Signing Off,

Kathy Strohmeyer