Health Savings Accounts: a Great Fit for Millennials

Employers, are your millennial employees prepared for the high costs of health care once they retire? Here’s how offering a Health Savings Account (HSA) as part of your benefits package now can help your employees be better prepared for these high costs later in life.

Mar 26, 2019

Employers, are your millennial employees prepared for the high costs of health care once they retire? Here’s how offering a Health Savings Account (HSA) as part of your benefits package now can help your employees be better prepared for these high costs later in life.

How can an HSA help millenials save for the future?

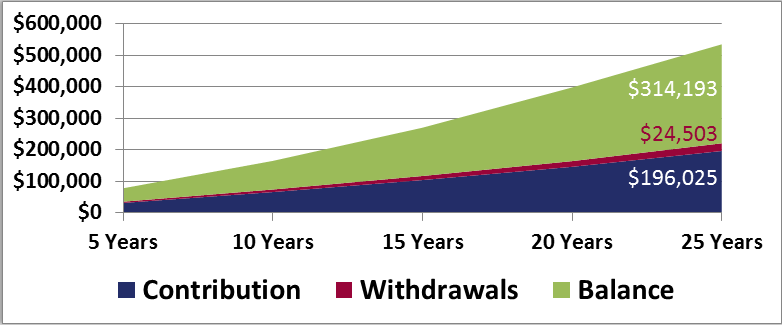

It’s estimated that the average couple retiring at the age of 65 will need $280,000 to cover health care and medical costs in retirement. This amount is up 2% from last year’s estimate of $275,000. HSAs are often overlooked as a way to save for retirement, when in fact they are a great way to save and grow a nest egg for retirement. HSAs provide a triple tax advantage. Contributions to an HSA are tax deductible, and investment earnings and distributions, when used for qualified medical expenses are tax free. Since money in an HSA can be invested, HSAs are especially great for millennials who have many years for the investments to grow. Millennials should view HSAs as a long-term investment account in addition to it simply being a way to pay for current medical expenses. Here is an example of how money in a HSA can grow over the years.

Assumptions: Participant is making maximum family contribution of $6,750 for current year and withdrawing $750 for current year eligible medical expenses. Estimated HSA contributions, deductibles and withdrawals are estimated to increase by 2% per year. Account growth rate is 4%. All examples are hypothetical and for illustrations purposes only.

How do HSAs help with future rising health care costs

By offering employees an HSA, you’re providing them with a tool that will help them be better prepared for rising health care costs in the future. While the IRS sets the annual maximum HSA contribution limits (for 2019, the self-only coverage is $3,500, and the family coverage is &7,000), employers can contribute money into participants’ accounts every year. In order to be eligible for a HSA, employees must be enrolled in a high-deductible health plan (HDHP) which typically cost less then a PPO health plan, providing cost savings to the employer and the employee. For many millennials that tend to be healthy–or are very selective when choosing medical care–they tend to have lower medical costs. Fewer expenses allows them to keep more of the money in their HSA and invested–growing for the future.

How to get started

At BPAS we offer the Roadways HSA solution that provides first dollar investing, so there are no minimum requirements to invest. Employers can offer this HSA product to their employees, giving them the opportunity to start growing their nest egg as soon as that first dollar is contributed to their account. To learn more about how our Roadways HSA can help employers and employees of all ages prepare for retirement please contact Hannie Spitzack, HSA Sales Relationship Manager at [email protected].