IRS Announces 2023 Cost-of-Living Adjustments

Oct 25, 2022

Last week, the IRS announced the 2023 Cost of Living Adjustments for retirement and benefit accounts. 2023 Cafeteria Plan and Qualified Transportation Benefit maximums are listed in IRS Rev. Proc. 2022-38....

Read more

Keeping Plan Participant Retirement Accounts Secure with Email Validation

An easy way to help prevent fraudulent retirement account activity is for plan participants to add a current, valid email address to their account.

Dec 26, 2017

One of the easiest ways to help prevent fraudulent retirement account activity is for plan participants to add a current, valid email address to their account. With an email address on record, BPAS will...

Read more

Contribution Amounts

When it comes to contribution amounts, simplicity is the greatest sophistication.

Oct 30, 2017

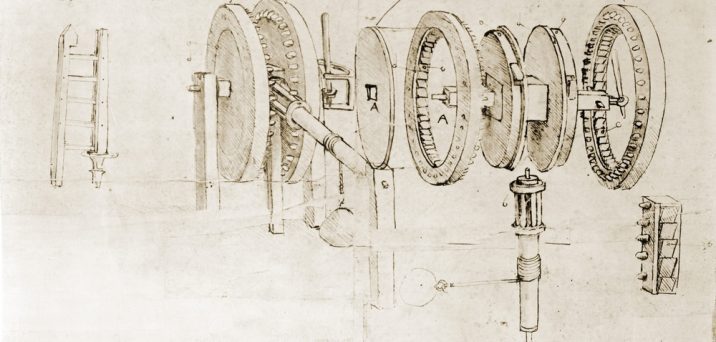

Simplicity is the ultimate sophistication. – Leonardo da Vinci Best known as a Renaissance artist, Leonardo Da Vinci also dabbled in the engineering world. His sketches essentially predicted some of today’s...

Read more

Financial Organization

Aug 07, 2017

When I first started driving, I didn’t have a GPS to help guide me. Instead, I had my dad. When I would get lost (which was way more than I’d like...

Read more

ACA’s Excise Tax – What Should Employers Do in 2015?

What Should Employers Do in 2015 for ACA’s Excise Tax?

Mar 02, 2015

Under the Affordable Care Act (ACA), the excise tax is 40% of the excess amount the plan’s health care cost exceeds limits as defined in the legislation. Although the tax...

Read moreDid You Know…You May be Eligible for Double Maximum Pension Tax Deductible Contributions?

Read this article to find out if you may be eligible for double maximum tax deductible contributions!

Jun 28, 2014

A business owner can accumulate about $2,600,000 in a traditional defined benefit or cash balance plan. To illustrate these results, let us assume that the company owner is age 52 and is...

Read moreHighly Compensated Employee Versus Key Employee: What’s the Difference?

There seems to be a great deal of confusion surrounding the determination of Key Employees and Highly Compensated Employees (HCEs):

May 26, 2014

There seems to be a great deal of confusion surrounding the determination of Key Employees and Highly Compensated Employees (HCEs): Are they one and the same? Why do we need to...

Read moreData Accuracy – Best to Get it Right the First Time

How important is it that you share correct data with your record-keeper? Let’s look at an example of what can happen with the plan’s non-discrimination testing first.

May 19, 2014

DATA. Yes, It’s a Four-letter Word. In fact, we hate using it so much that entire departments in companies all over the world went from being called “Data Processing” to “Information...

Read moreUnderstanding the Difference Between Eligibility and Allocation Conditions

Two provisions that are commonly misunderstood and incorrectly used interchangeably are: Eligibility Requirements and Allocation Conditions.

May 12, 2014

Two provisions that are commonly misunderstood and incorrectly used interchangeably are: Eligibility Requirements and Allocation Conditions.

Read moreYou’ve Just Inherited A Retirement Account…Now What?

Congratulations! You've inherited a retirement account! What do you next? Here are three options.

May 05, 2014

Congratulations! You’ve inherited a retirement account! What do you do next? Here are three options. Option 1: Open An Account Called An Inherited IRA With this option, you can rollover the...

Read more