Building a Nest Egg – It Pays to Start Today

Learn why smart investors can use an employee contribution plan, to start building a nest egg for the future.

Dec 21, 2015

As a recent college graduate, I understand why saving for retirement is not necessarily at the forefront of my peers’ minds. Sure, retirement is inevitable, but our individual focus is on the beginning of our careers, not the end of it. The consensus amongst us 20-somethings is that there is so much time before our golden years that we can worry about retirement planning later. Ah, but all that time is our greatest tool in building our nest egg! Why is that, you may ask? It’s because of the magic of compounding interest.

Most financial planners recommend having several sources of retirement income. The possible sources include Social Security, defined contribution plans, defined benefit plans, and personal savings. Recently, more employers sponsor defined contribution plans (i.e. 401(k) or 403(b) plans) rather than defined benefit plans. For that reason, let’s look at two hypothetical scenarios on how an employee could contribute to a 401(k) account to observe the magic of compounding interest.

Simply put, compounding interest occurs when interest accrues on deposits and on previously earned interest. So why does that matter?

The Early Investor Succeeds

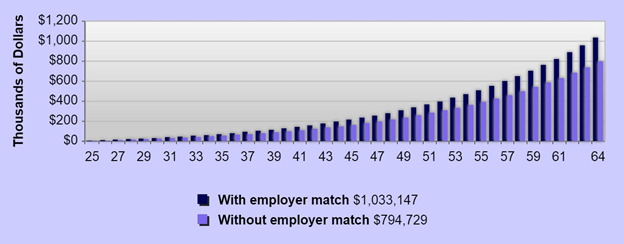

In our first scenario, an employee begins contributing to the 401(k) at age 25 with an annual salary of $30,000. With annual contributions of 10% of annual income, we’ll assume their salary grows 2% annually. Let’s also assume an employer match of 50% of employee contributions to a maximum of 6% of the employee’s annual salary. Assuming retirement at 65, our employee would have contributed to their 401(k) account for 40 years, accumulating a balance of $1,033,147.

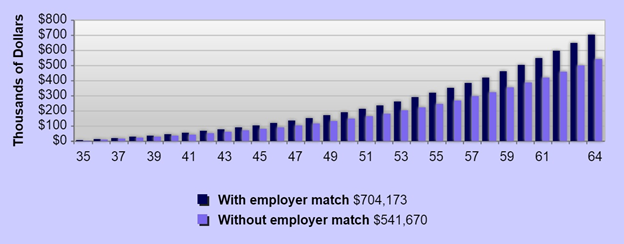

For the second case, assume our employee starts contributing at age 35 with an annual salary of $45,000. Keeping all other assumptions equal, after 30 years of contributions, their 401(k) balance will have grown to $704,173. Clearly, the employee who begins saving 10 years sooner ends up with a larger nest egg, almost 50% larger in fact. However, what is most intriguing is that the total employee and employer contributions are nearly the same in both scenarios. How can that be true with such different outcomes you ask? The answer is time, with the difference driven by those 10 additional years of compounding interest. You can see it literally pays to start saving sooner rather than later!

* The calculations in the two scenarios are hypothetical and for illustrative purposes only. In both cases, we assume that the employee contributes 10% of their annual income from their respective starting ages (25 and 35) until an assumed retirement age of 65. Both scenarios assume an annually compounded rate of return of 7% and an annual salary increase of 2%. Also assumed is an employer match of 50% of the employee contributions up to a maximum of 6% of the annual salary.

Now, I realize it may be hard for twenty somethings to justify saving for retirement with student loans, current bills and figuring out your post-grad life staring you in the face. Just remember that even saving a little now can go a long way in the end. Do not be afraid to start small – over time as your income grows and your debt lessens, you can always increase your contributions. But you cannot make up for that lost time!

Estimate Your 401(k) and More!

The calculations above were created with the 401(k) Calculator available on the BPAS.com. To use this tool or one of the other useful calculators available to estimate your retirement savings, visit BPAS.com.