BPAS Transaction Tips

When talking to participants, I often receive questions about transactions. Here are some of those questions to help you in completing transactions.

Jan 16, 2018

When talking to participants, I often receive questions about transactions. I’ve compiled some of those questions into this post to help you in completing transactions.

How do I make trades in my account?

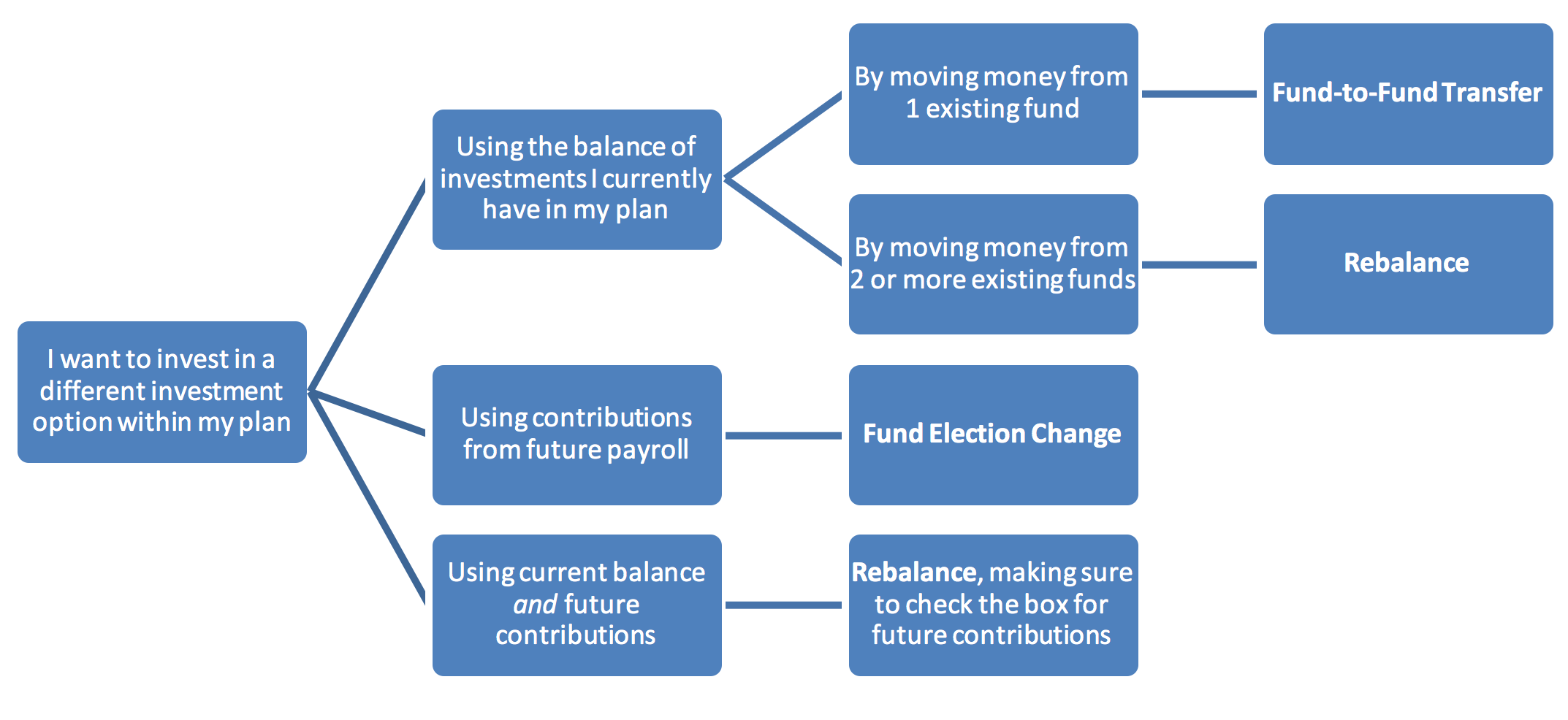

To enact a trade in your account, log in at www.bpas.com. There are three different ways to conduct trades: Fund Election Change, Fund-to-Fund Transfer or Rebalance. You can select the appropriate one from the Transactions drop-down or from selecting the appropriate widget. Below is a breakdown of the best one to use for your appropriate scenario:

How come there’s still a balance in a fund I traded out of?

If you have a few dollars remaining in a fund that you previously traded out of, there could be a few explanations.

1. You may have completed the trade with a dollar amount instead of percentage. For example, on the day of the trade, you had $5,000 in the fund you wanted to trade out of, so you did a fund-to-fund transfer of exactly $5,000. The trade doesn’t occur until the market close, so if the fund value increased that day, you’re left with the earnings remaining in that original fund.

Note: The system is set up to automatically correct trades with a dollar amount of 90% or more of the fund’s value, but sometimes the original trades were completed so long ago that this safeguard feature was not yet established.

2. You may have completed a fund-to-fund transfer but did not update your fund elections. In cases like this, your balance was transitioned to the new investment option(s) you selected, but the next payroll contribution went to the previous fund(s) you selected.

No matter the reason or the timing, these changes can be easily fixed. Simply go back into your account and complete a Fund-to-Fund Transfer, moving 100% out of the fund that you’d no longer like to invest in. Be sure to review your Fund Elections, as well to make sure future contributions are being directed to the fund(s) you’d prefer.

The system won’t let me complete a transaction.

Some funds have restricted trading policies established to prevent investors from moving in and out of funds too frequently (also known as day trading). If your Plan has any of these funds that are impacted by this, you can find out the details by selecting Fund Information and then Fund Restrictions.

If you are in a fund that is impacted by a restricted trading policy, you will not be able to perform a fund-to-fund trade out of that investment or rebalance your account until the specified time frame has elapsed. You can complete fund-to-fund transfers out of the other investment options in your plan and you can also update your Fund Elections during that time frame.

Note: The restricted trading calendar restarts any time additional assets are made into that investment option, including payroll contributions. You might want to change your future investment elections to prevent the clock from constantly restarting itself.

Is there a way to check and see if I need to rebalance my account?

Yes, and it’s really easy! Go to Transactions and then Rebalance. On that screen, you’ll see all of the investments in your Plan and the ones that you specifically are invested in. The Current Value % shows the percent of your account balance in that fund as of today and the Current Election % will show you how much you have directed each payroll to that fund. For example, you may see Fund A at a Current Value % of 15.5% and a Current Election % of 10%—which means that Fund A is accounting for an extra 5.5% percent than you originally allotted for. It’s up to you to determine if you are comfortable with that allocation variance or not. If you decide to make a change, you can simply rebalance right on the same screen.

Why would I want to automatically rebalance my account?

Our rebalancing screen allows you to automatically rebalance quarterly, semi-annually or annually. There are a few reasons you may want to consider establishing auto-rebalance:

It’s fast. If you spent time determining an asset allocation and setting up your funds accordingly, you may not be interested in spending more time going through the process again. By checking the auto rebalance button, you’ll save yourself some time in the future.

It’s convenient. By setting up your account to automatically rebalance, it’s one less thing to remember to complete. The system will make the trade based on the schedule you set and, if needed, you can cancel it at any time.

It takes the emotion out of investing. Investing is not supposed to include our feelings, but too often, we make changes to our account based on moods and behavior. Since automatic rebalancing occurs based on a specified date, your trades are not going to be hastily made due to a market swing or external financial concerns.